Gold Etf Funds Fidelity

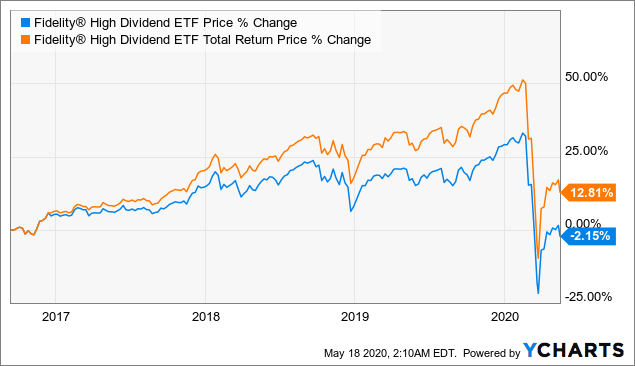

Exchange traded funds or etfs are a type of investment that can help you diversify your investment portfolio and strengthen your low cost investment plan.

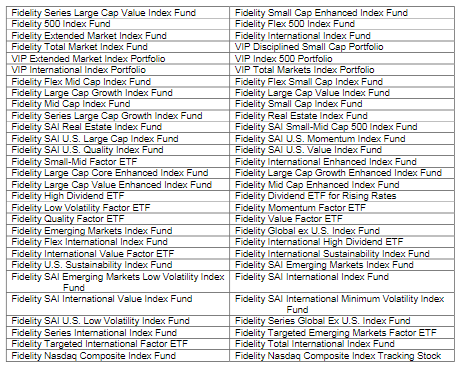

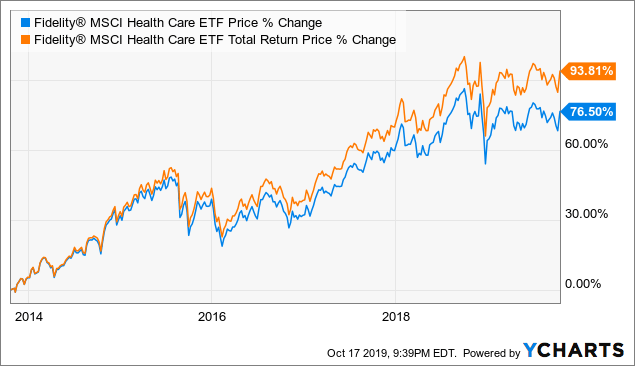

Gold etf funds fidelity. Funds in this category typically invest in stocks related to gold and other precious metals which. The fidelity select gold portfolio fund falls in morningstar s equity precious metals category. Fidelity exchange traded funds etfs are all available for online purchase commission free and include actively managed factor sector stock and bond etfs. This spdr fund is the go to way for investors looking to play precious metals with nearly 80 billion in assets under management since 2005 the fund has allowed investors to purchase gold via.

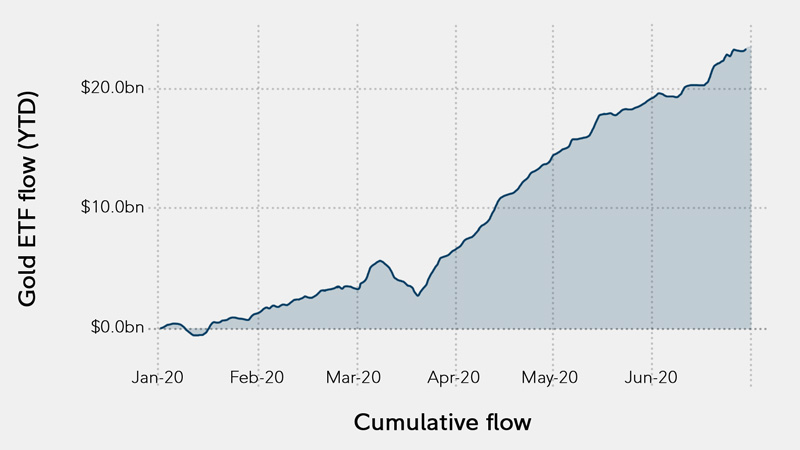

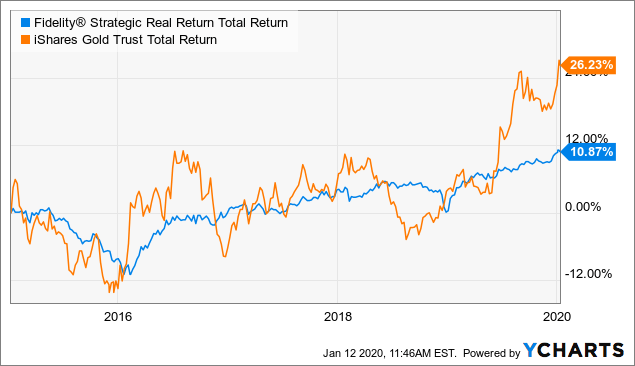

The spdr gold shares gld 178 70 is the first u s traded gold etf and as is the case with many first funds it also has more assets than any of its competitors by almost three times its. Other etfs backed by bullion include ishares comex gold trust iau and etfs physical swiss gold shares sgol. For example you can purchase mutual funds and exchange traded funds etfs that invest in the securities of companies involved in the production of gold and or other precious metals. Unlike other etfs gold backed funds are taxed up to 25 as collectibles.

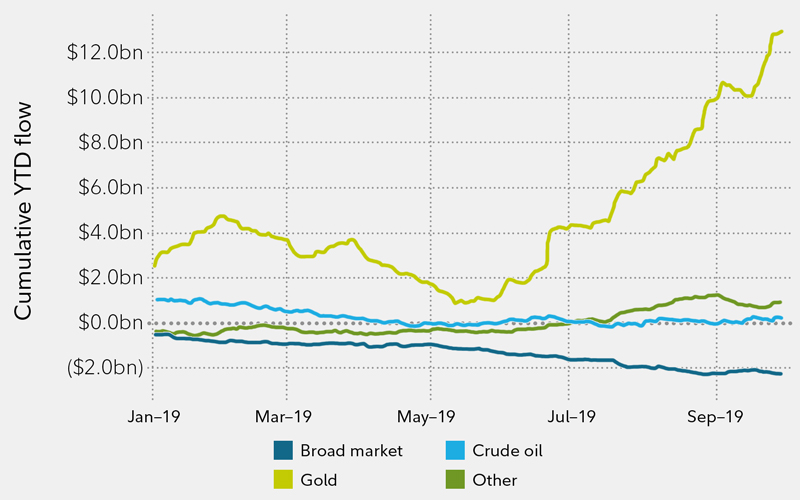

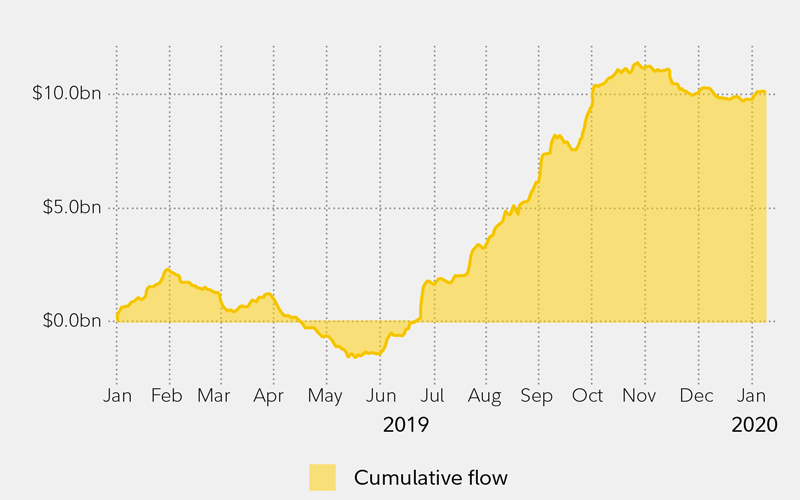

There are currently 9 etfs focused on tracking the price of gold excluding leveraged or inverse funds. Fidelity offers additional ways to gain exposure to precious metals. Learn more about investing in etfs from the financial experts at fidelity investments. One caveat for investors who want access to physical gold is the tax implication.

For ishares etfs fidelity receives compensation from the etf sponsor and or its affiliates in connection with an exclusive long term marketing program that includes promotion of ishares etfs and inclusion of ishares funds in certain fbs platforms and investment programs.

:max_bytes(150000):strip_icc()/fidelity_investments_productcard-5c742f0e46e0fb000143628b.png)