Gold Etf Funds Meaning

Business software services industry etf.

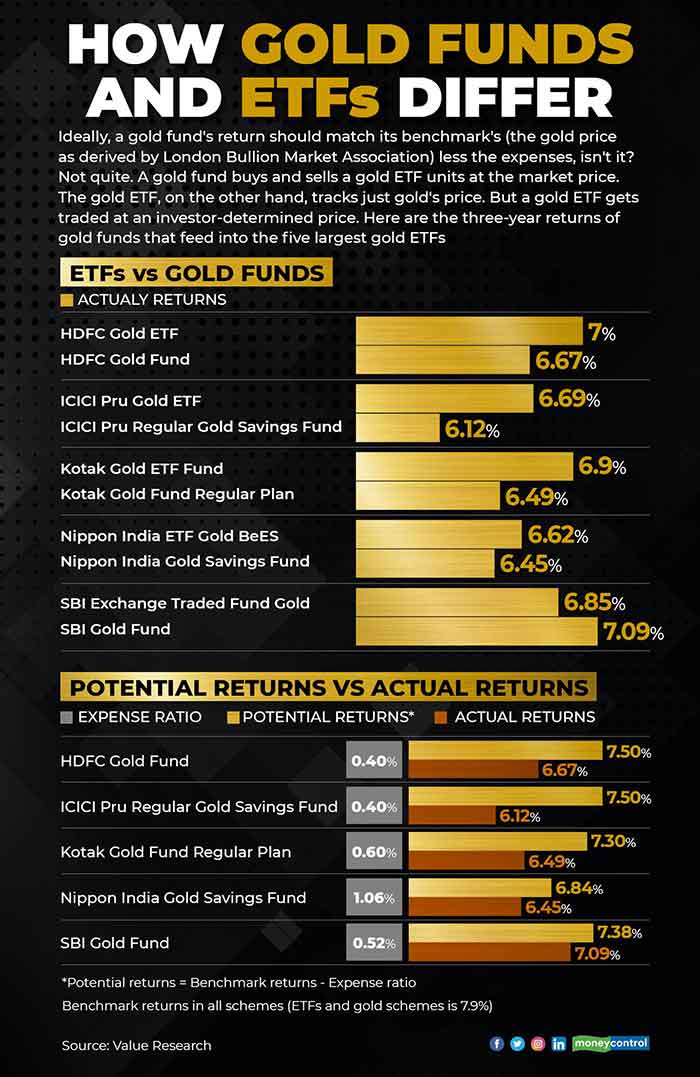

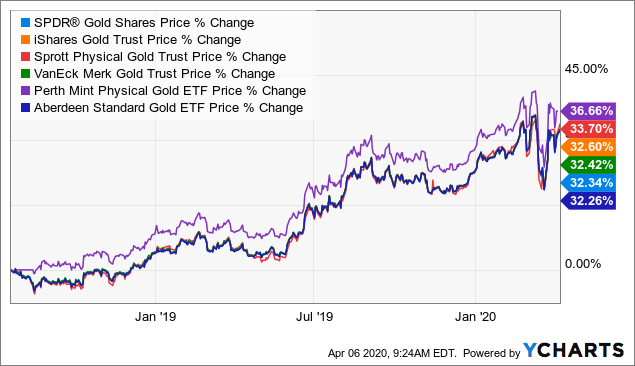

Gold etf funds meaning. The price of gold increased by 39 2 in the past year significantly exceeding the. The spdr s p metals mining etf nysearca. A gold etf is a commodity exchange traded fund that can be used to hedge gold commodity risk or gain exposure to the fluctuations of gold itself. Xme is a prime example of a struggling mining etf and those struggles can be sourced to the fund s diversified approach meaning its roster is.

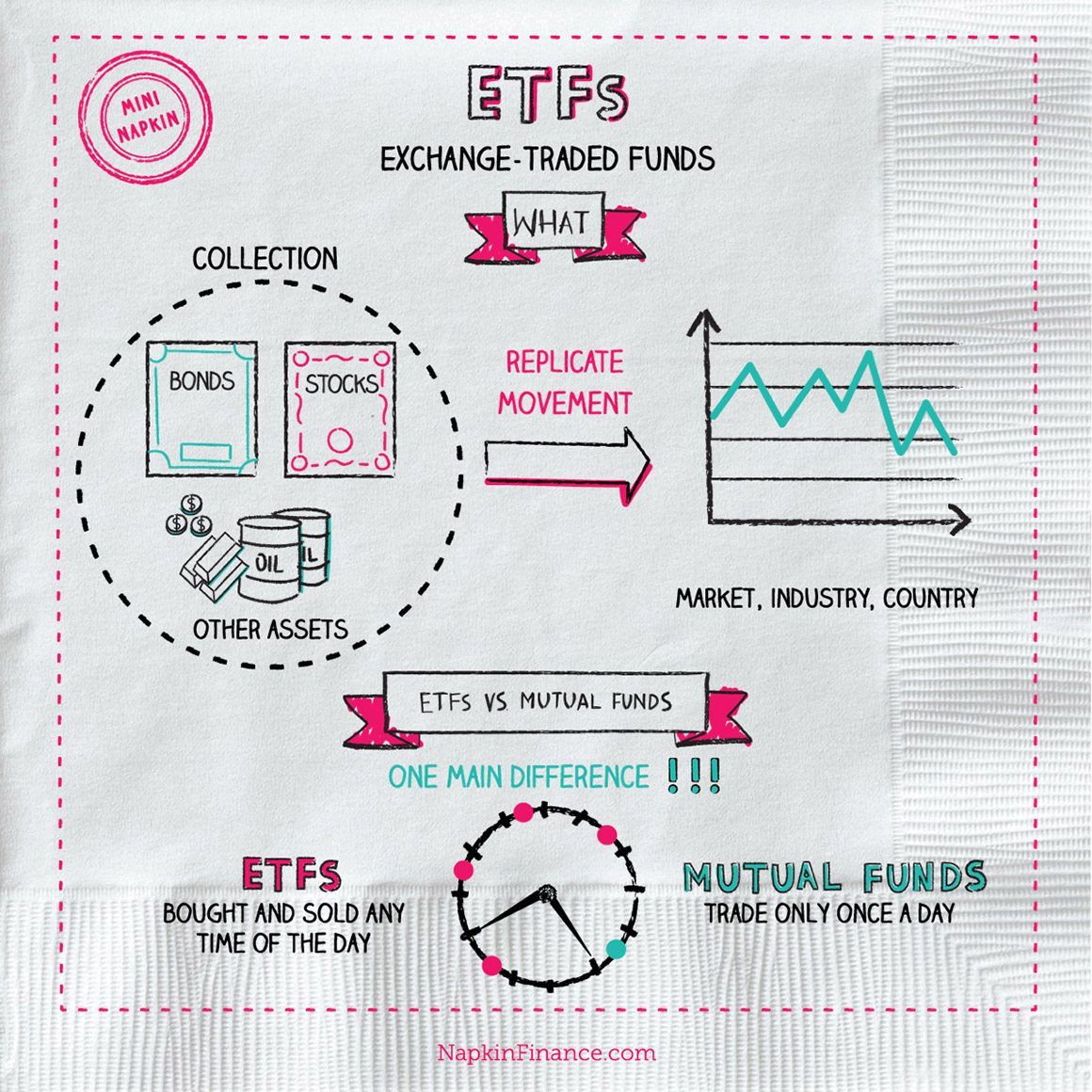

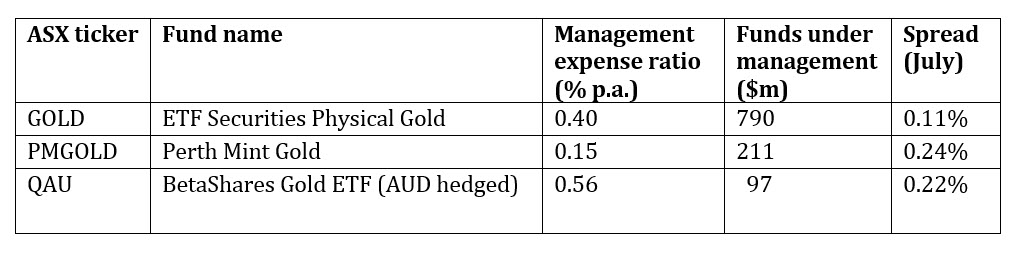

It is suitable for investors who have a desire to take exposure to gold. Gold etfs are open ended exchange traded funds that will invest the money in standard gold bullion gold with 99 5 purity. An exchange traded fund etf that invests in business software companies with the objective of replicating the performance of an underlying software. There are currently 9 etfs focused on tracking the price of gold excluding leveraged or inverse funds.

Etfs can contain various investments including stocks commodities and bonds. These exchange traded funds perform like individual stocks and are traded similarly on the stock exchange. Exchange traded fund etfs an exchange traded fund etf is a basket of securities that tracks an underlying index. Gold etf or exchange traded fund is a commodity based mutual fund that invests in assets like gold.

Exchange traded funds represent assets in this case physical gold both in dematerialised and paper form. The price of shares within a gold fund should correlate very closely to. If an investor has increased risk on his portfolio assets when the price of gold rises owning a gold etf can help reduce risk in that position. The basic aim of the fund is to create wealth by tapping the potential of gold as a commodity.

A mutual fund or exchange traded fund etf that invests primarily in gold producing companies or gold bullion.

:max_bytes(150000):strip_icc()/GettyImages-1151189114-3f70002f53bb427ea2bc292832bbdfe8.jpg)

:max_bytes(150000):strip_icc()/gold_461188561-5bfc376346e0fb00517ef668.jpg)

:max_bytes(150000):strip_icc()/istock_000072666561_medium-5bfc3ab4c9e77c00519eb8e1.jpg)

:max_bytes(150000):strip_icc()/woman-checking-financial-trading-data-with-smartphone-in-city-821775562-2f853f7c9d3b42e8824f6f2b8a58a776.jpg)