Gold Etf Investment Procedure

The shares are designed for investors who want a cost effective and convenient way to invest in physical gold p.

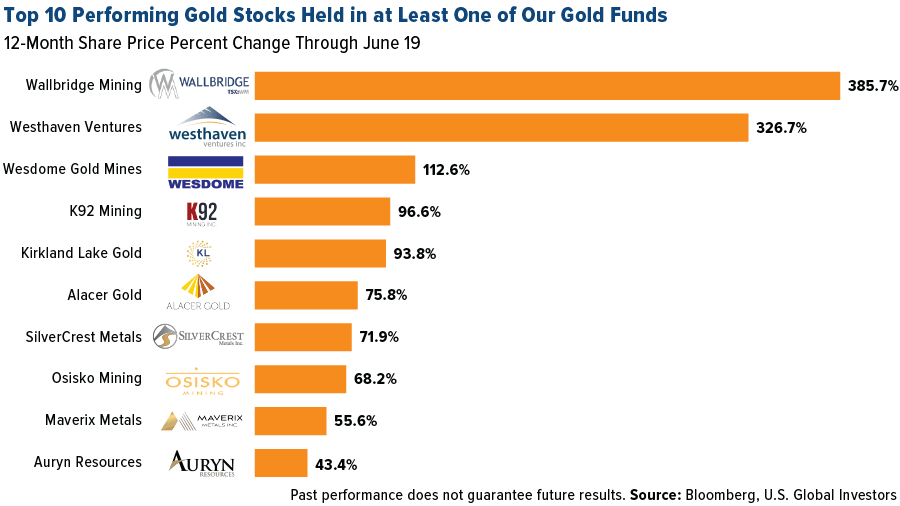

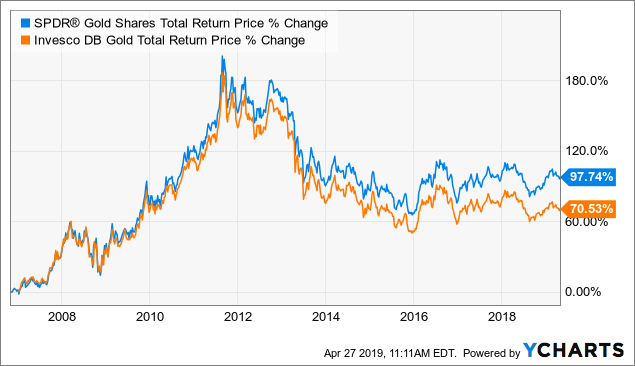

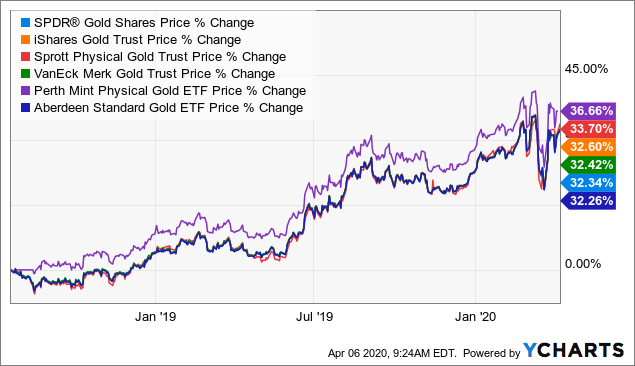

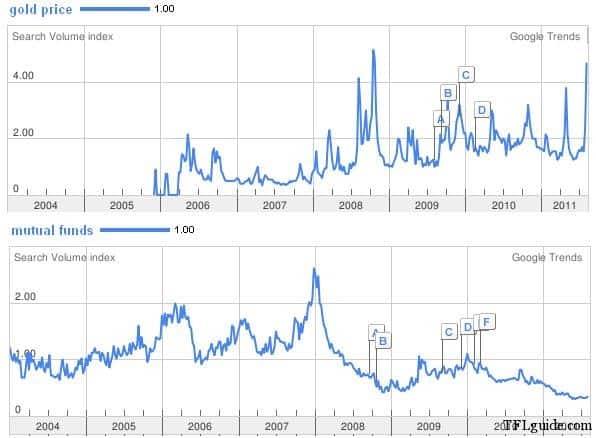

Gold etf investment procedure. It is the insurance you need to safeguard your portfolio that can be easily accessed through an etf on the asx. Those etfs have returned 42 over the past year and 20 year. The price of gold has risen 39 0 over the past year and the vaneck vectors gold miners etf the gold mining company benchmark index has risen 60 1. Using spdr gold shares nysemkt gld an exchange traded fund etf that owns physical gold as a proxy gold has rallied by roughly 33 since hitting a low in roughly mid march.

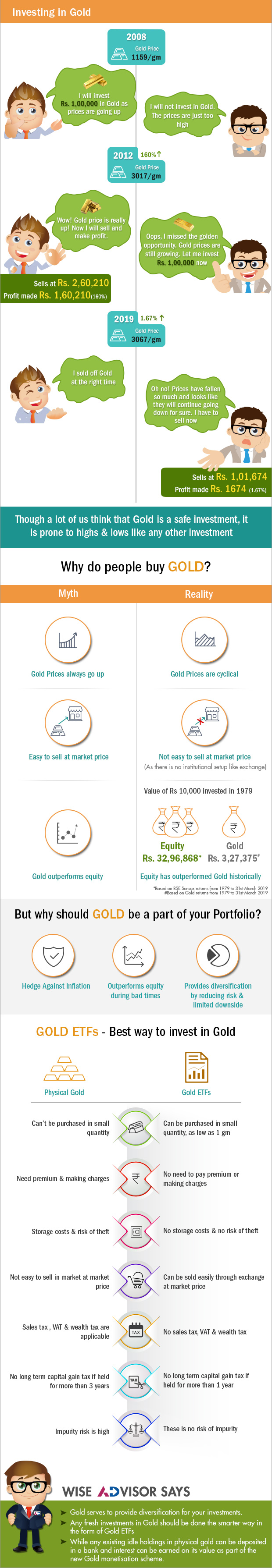

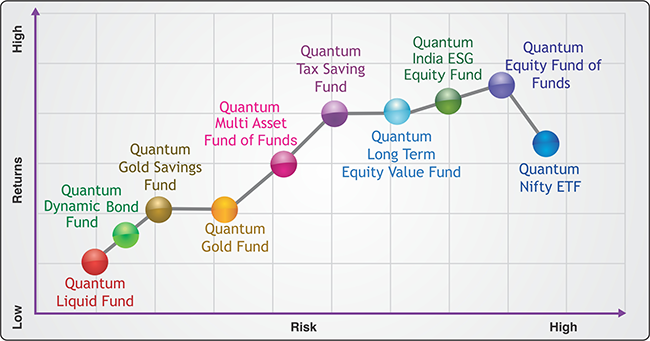

Indians love for gold is no secret. Gold etfs are the same as mutual fund units where each unit is equivalent to one gram gold though some funds give the option to invest in lower denominations of 0 5 gram as well. The spdr gold trust and the ishares gold trust are both large funds with reasonable expense ratios that track the spot price of gold. The investment objective of the trust is for the shares to reflect the performance of the price of gold bullion less the expenses of the trust s operations.

Gold etfs are listed on the exchanges and invest in physical gold. Each unit of a gold etf represents 1 2 gram of 24 karat physical gold. In comparison the s p 500 is up 15 8. Investing in gold backed etfs provides a liquid and cost effective access to gain exposure to the precious yellow metal.

Having gold in your portfolio can significantly reduce how much you lose when markets are falling. For long it has been one of our go to investment product. Aberdeen standard physical gold shares etf the shares are issued by aberdeen standard gold etf trust the trust. Gold etfs provide ample liquidity as these can be sold on.

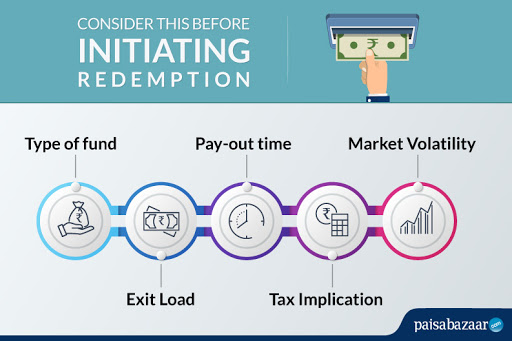

When it comes to investing in gold there are two main ways to do it buy physical gold or invest through an exchange traded fund etf although the etf route comes with an annual expense ratio.