Gold Ira Tax Rules

Gold ira rules regulations precious metal ira faq updated 2020 most of the money in the world including the us dollar is fiat currency fiat currency is a currency that a government declares legal tender but which is not backed by any physical commodity.

Gold ira tax rules. In order to be compliant with gold ira tax rules you must limit your precious metal purchases to coins and bars acceptable to the irs. Although us congressional efforts are underway to potentially repeal capital gains taxes on constitutional gold and silver monies h r. 6790 we want all bullion buyers and sellers to understand current bullion buying privacy statutes bullion dealer reporting thresholds when repurchasing bullion from customers and finally some potential current bullion tax gain loss parameters to consider. Rules against holding collectibles the tax code prohibits ira holders from investing in life insurance the stock of an s corporation or collectibles.

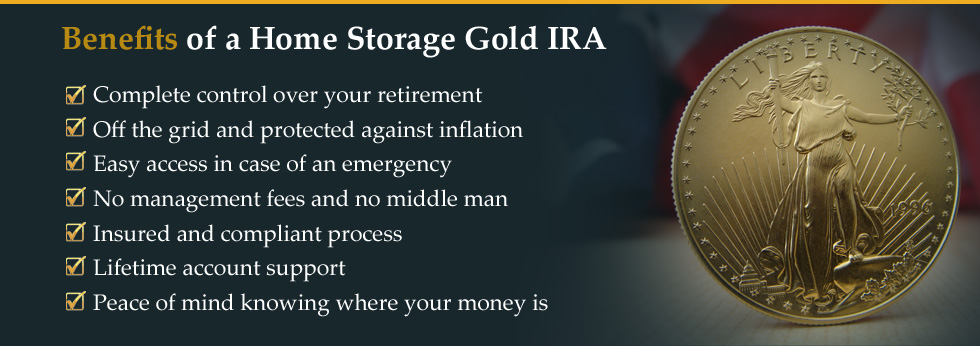

It effectively removed the barriers in the u s. Department of treasury and state governments can be purchased with your ira funds. Gold ira tax rules rollover secrets get your free no obligation gold ira investment kit now to learn more about a secret ira loophole. Even if you are gold investing with your precious metals ira it is highly recommended that you understand more about how the best gold ira rollover works.

Other issues with owning gold in an ira. Otherwise you will be subject to an excise tax and your ira may lose its status as an ira. Instead sales of physical gold or silver need to be reported on schedule d of form 1040 on your tax. The tax code also says the gold or silver must be held by an irs approved custodian or trustee though some gold ira marketers claim there s a loophole in this law more about this later.

The basic tax rules for investing your ira funds prohibit purchasing precious metals in the form of coins or bullion with a few exceptions. Tax liabilities on the sale of precious metals are not due the instant that the sale is made. Certain coins issued by the u s. Some types of gold coins are classified as collectibles and would violate the rules.

Tax code that prevented such investments and gave investors an alternative to traditional iras that hold stocks and bonds.